Environmental Sector

Situation in Japan

The environmental business market is expanding in Japan. In 2021, it reached a record high of JPY 108.1 trillion. Growth is especially noted in businesses employing renewable energy in their measures to address global warming and engaging in waste treatment and efficient use of resources.

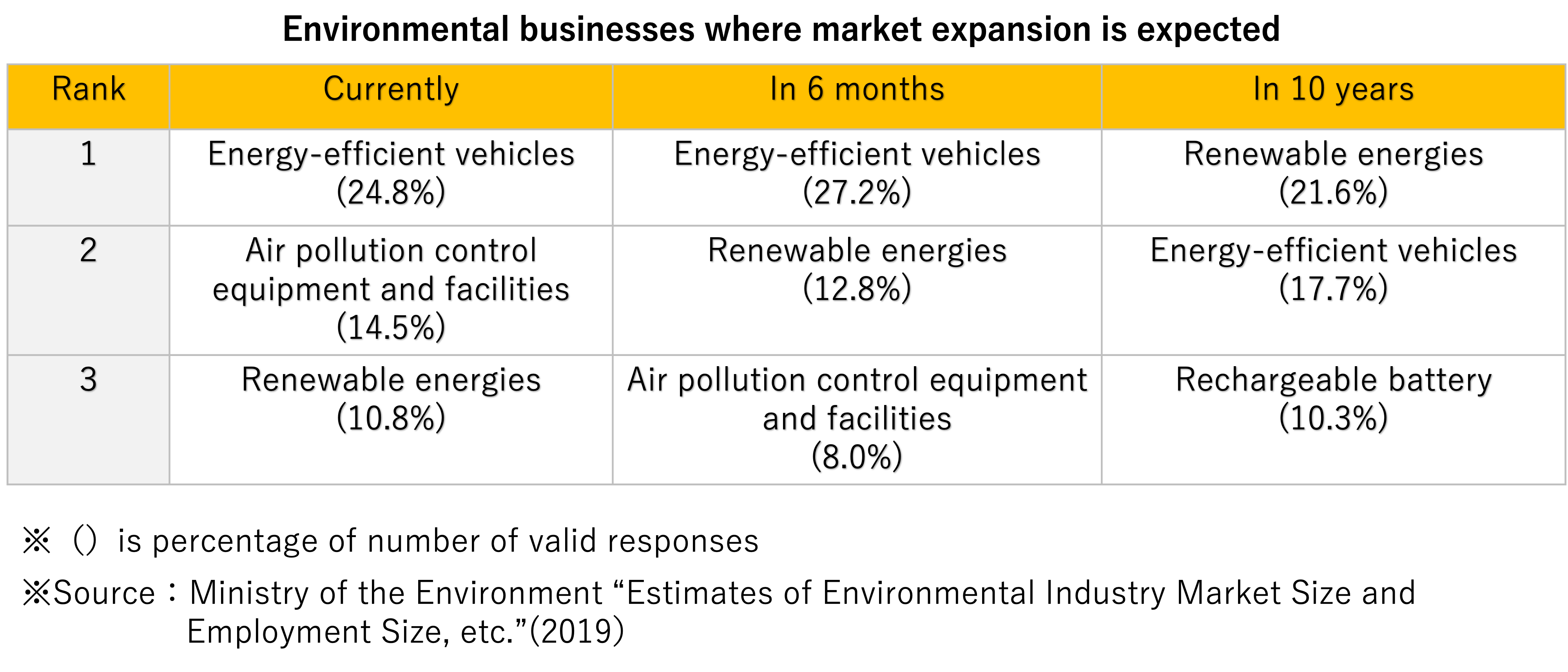

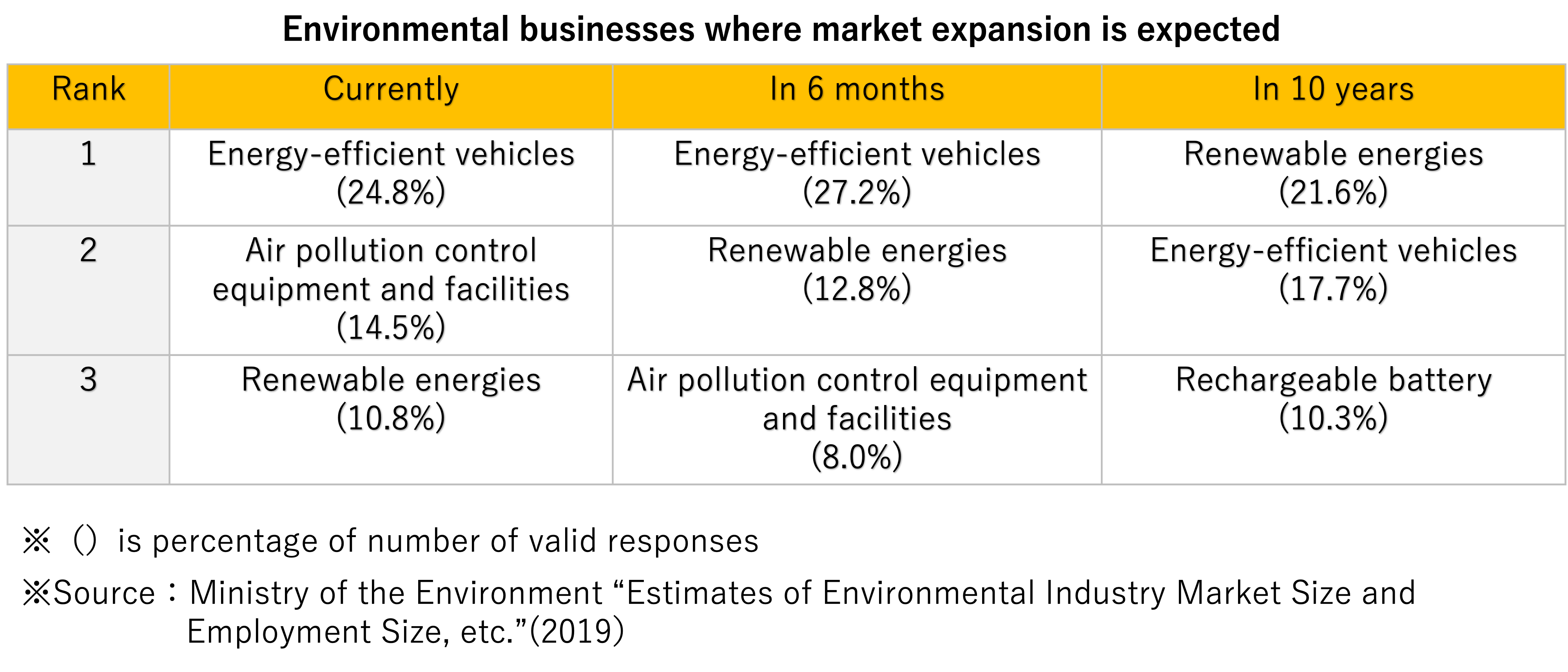

The 2011 earthquake and tsunami led to demands in Japan to secure a more flexible and efficient energy supply system utilizing various energy sources to ensure a stable supply of energy, which is the foundation for industrial activities. As such, initiatives to expand the use of renewable energy are urgently needed. In addition, the Paris Agreement adopted at the COP21 UN climate change conference held in December 2015 set forth that all countries, including developing nations, cooperate and engage in new measures to address global warming from 2020. To this end, businesses related to renewable energies, energy-efficient vehicles and other energy-saving products are viewed to be promising.

Energy-saving products*

*Buildings, electric appliances, utility equipment, energy-saving utility services

- Market size

-

- JPY 16.2031 trillion(2021)

- Market growth potential

-

- With expansion of renewable energies, the market for energy management such as smart homes and smart meters is expected to grow.

- Advantages of setting up business in Tokyo

-

- Tokyo has about 30 percent of all the office buildings in Japan, making it a large potential market for energy-efficient systems.

- The Tokyo Metropolitan Government introduced mandatory targets for reduction in overall greenhouse gas emissions and the cap-and-trade program in FY 2010, and the second compliance period started from FY 2015. Against this backdrop, it is expected that demand for energy-efficient systems in office buildings will continue to increase.

- In the Tokyo Metropolitan Government's Basic Strategy for Promotion of Industry (2011-2020), environment and energy related industries are positioned as industries that solve social problems. Along with cultivating these industries as key industries, in order to effectively support them, the government actively makes its sites available for implementation of field tests to facilitate commercialization of new products, technologies, and services developed by private businesses. It can be expected that there will be opportunities for foreign affiliates with excellent technologies to participate in such verification projects

Sources:

Ministry of the Environment "Report on the Market Size and Employment of the Environmental Industry" (2023)

Storage battery

- Market size

-

- Energy storage system JPY 984.1 billion(2021)

- Energy storage device for vehicles JPY 425.1 billion(2021)

- Market growth potential

-

- It is projected that demand for residential use solar power will grow due to an expansion of the output control system and staged reduction of the renewable energy feed-in tariff. It is also forecasted that shifts in peak demand will increase due to ongoing application of night rates for power use at night. This is projected to also increase storage battery demand.

- Advantages of setting up business in Tokyo

-

- The head offices of many home builders and auto makers that need storage batteries and related devices are located in Tokyo and its surroundings, making Tokyo the perfect location for marketing activities. Including dedicated manufacturers, many foreign affiliates manufacturing storage batteries have set up bases in Tokyo and are conducting business activities here.

- The Tokyo Metropolitan Government has substantial systems for subsidizing introduction of storage batteries. These include subsidies for residential use storage batteries and subsidies toward small and medium-sized businesses (small and medium-sized health care and welfare facilities and public baths) for energy creation and energy saving equipment. These systems are stimulating demand for storage batteries.

Sources:

Ministry of the Environment "Report on the Market Size and Employment of the Environmental Industry" (2023)

Ministry of Economy, Trade and Industry "Current Survey of Production"(2022)

Cogeneration systems*

* System using a common energy source to produce both electricity and steam for other uses, resulting in increased fuel efficiency.

- Market size

-

- Cumulative number of systems introduced 22,156(2022)

- Cumulative capacity 13,667MW(2022)

- Market growth potential

-

- As a cogeneration system has high power generation efficiency and makes it possible to use waste heat, its installation as an energy-saving measure is anticipated. Through connection to the power grid, the cogeneration system can also double as a standby power source. With needs for energy security increasing since the 2011 earthquake and tsunami, it is projected that there will be a demand for cogeneration systems for disaster response.

- Advantages of setting up business in Tokyo

-

- Japan's installed capacity for industrial cogeneration was 10,863 MW at the end of March 2023, while that for consumer use remained at 2,804 MW. Tokyo has a large potential market due to the concentration of important urban functions.

- In order to promote Tokyo's transformation into a smart energy city, the Tokyo Metropolitan Government aims to introduce business use cogeneration systems with a capacity of 600,000 kW by FY 2024, double that of FY 2012. The 5-Year Environment Plan formulated by the Bureau of Waterworks in March 2015, aims to introduce cogeneration systems to all large-scale water purification plants and expand capacity to a total of some 50,000 kW by FY 2019. From this background, demand for cogeneration systems in Tokyo is forecasted to grow even more.

- In order to promote the spread of cogeneration systems, the Tokyo Metropolitan Government has several subsidy systems such as subsidies for installation of home fuel cells (Ene-Farm) and installation of gas cogeneration systems in office buildings and other facilities, and this is promoting greater demand for related devices in Tokyo.

Sources:

Advanced Cogeneration and Energy Utilization Center JAPAN "IStatus of cogeneration (CHP) introduction in Japan" (2023)

Tokyo Metropolitan Government "Report by the Study Group for Expansion of Renewable Energy Use" (2014)